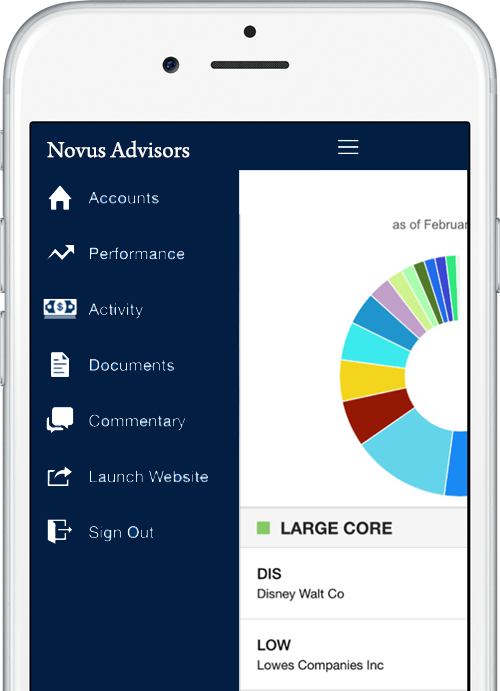

EVERYTHING IN ONE PLACE

All your investment accounts in one place.

CHECK YOUR PERFORMANCE

Check on your investments from anywhere, easily.

MARKET INSIGHTS

Find commentary and get exclusive

market insights.

Novus Advisors App

With the new Android and iPhone app

you can easily check on your investments

from anywhere.

Download iOS App

Download Android App

Newsletters

-

Key Retirement and Tax Numbers for 2024

This article presents the IRS’ cost-of-living adjustments for 2024 that affect contribution limits for retirement plans and various tax deduction, exclusion, exemption, and threshold amounts.

-

How to Kill Your Zombie Subscriptions

With inflation cutting into consumers’ purchasing power, getting rid of a few unnecessary recurring charges could be a painless way to help balance the household budget.

-

Setting a Retirement Savings Goal

Only 51% of workers or their spouses have tried to estimate the savings they would need to live comfortably in retirement. This article offers a simple worksheet to help calculate a savings target.

-

New Medicare Rules Tackle Prescription Drug Prices

The Inflation Reduction Act of 2022 included provisions intended to lower prescription drug costs for Medicare enrollees and slow drug spending by the federal government.

Calculators

-

Credit Card Debt

How Long Will It Take to Pay my Balance?

-

Estate Taxes

Use this calculator to estimate the federal estate taxes that could be due on your estate after you die.

-

Savings Goals

How much do you need to save each year to meet your long-term financial goals?

-

Loan Payoff

How much will it cost to pay off a loan over its lifetime?